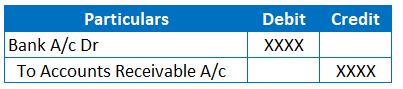

When the proprietor makes payment to the company regarding the profitable sale of products or companies, the agency must reverse the fee receivable and record cash. The journal entry is debiting money and credit score commission receivable. Fee Acquired refers to a share quantity acquired by the company (or) a person on the total sales incurred. It is an oblique income/revenue recorded on the credit score side of profit and loss account.

Journal Entries

Journal entries are important for accurate fee accounting, offering transparency in monetary transactions. Each commission entails a debit to fee expense and a credit to fee payable, affecting firm expenses and marking a legal responsibility on the stability sheet. To record the receipt of a commission, we have to make a journal entry that displays the increase in money and the rise in fee income. The money account is debited because money is received, and the fee earnings account is credited as a outcome of it represents income earned. The agency needs to record fee revenue when they should make a profitable sale for the proprietor of the products.

Accounts Receivable Journal Entries

Please put together the journal entry for the fee receivable. Commission receivable is represented as accounts receivable on the balance sheet, they need to acquire cash from the vendor of goods. Commission earnings will current as revenue on the earnings assertion. On the other aspect, the entity that receives fee needs to report commission income. The firm will receive a fee that is aligned with the sale made. The company that receives a commission is often referred to as the company.

- Corporations should establish clear profitability and finances targets to ensure commissions encourage sales behavior that supports these objectives.

- Therefore, the exact reporting of paid and acquired commissions ensures that stakeholders obtain a true representation of the company’s fiscal place.

- It aligns monetary objectives with sales incentives, driving development.

- One of an important principles is the matching precept, which requires that commission expenses be recognized in the identical accounting interval as the related gross sales income.

Understanding terms like fee paid journal entry and their implications in accounting is important for sound financial administration. This entry connects sales to commission expenses, guaranteeing correct financial data for compliance and readability. Precision is vital when creating journal entries, as errors can cause misstatements. Analyzing these entries supplies insights into gross sales trends, helping companies optimize commission plans to align with gross sales targets.

They only promote and sell to the patron, and charge primarily based on the profitable sale amount. Fee cost is the price that company spends solely on the sale made. It shall be classified as variable price and it is straightforward for them to manage. The company normally sets a fixed amount or percentage to calculate the commission expense. A Provision in accounting is mostly some put aside earnings to be used underneath particular contingencies. They are the reserves which are being made for specific conditions and are to be compulsorily utilized in those circumstances solely.

It is earnings to the entity in exchange for offering providers or making affiliate gross sales. The transaction will lower fee receivable by $ 5,000 and increase money by $ 5,000. An earnings that has not been earned but, but has been received in advance is called https://www.intuit-payroll.org/ Unearned Earnings.

A salary is a fixed quantity the employer should pay the employed sales consultant no matter whether the gross sales rep. manages to promote something or not. Commission earnings is an quantity earned in exchange for transacting a sale of a product or offering a service. Implementing best practices in fee accounting can streamline processes and enhance accuracy. Sometimes items of a enterprise are used in the business itself.

There can be a scenario the place the curiosity is charged first after which acquired. Depreciation is the lower within the value of assets due to make use of or regular wear and tear. Transactions related to the acquisition and sale of products can be of two sorts, Money or Credit Score. You can download my adjusted calculator right here – this is the one I used for all the Associates in my prior examples on this page. This includes the setup for each mounted value and proportion primarily based calculations.

We will take real-life business scenarios to elucidate this concept absolutely. This part additionally covers how to move entries in Tally and explains the use of ledgers. Commission received journal entry is a Cash/Bank A/c Debit as a outcome of This will increase the money or bank steadiness, reflecting the receipt of fee. Credit Score to Commission Received A/c as a outcome of This increases the fee received account, reflecting the income earned. When a business receives commission, it needs to document this revenue precisely in its accounting data.

Maintaining exact obtained commission journal entries is instrumental in fostering financial transparency within a corporation. By documenting the influx of commissions in a scientific manner, businesses demonstrate a dedication to accountability and integrity, thereby enhancing stakeholder trust and confidence. Typically, fee expenses are categorised as an operating expense on the earnings statement.

A provision is seen as an upcoming liability and should not be handled as savings. Provisions journal entry is handed to indicate the amount set aside by the firm to fulfill contingencies. A Journal is a e-book in which all of the transactions of a business are recorded for the first time. The strategy of recording transactions in the journal is identified as Journalising and recorded transactions are called Journal Entries.